This story was originally predicated upon a large transaction that closed this past week. However, those involved preferred discretion and the transaction instead prompted me to provide a Year in Review.

A Year in Review

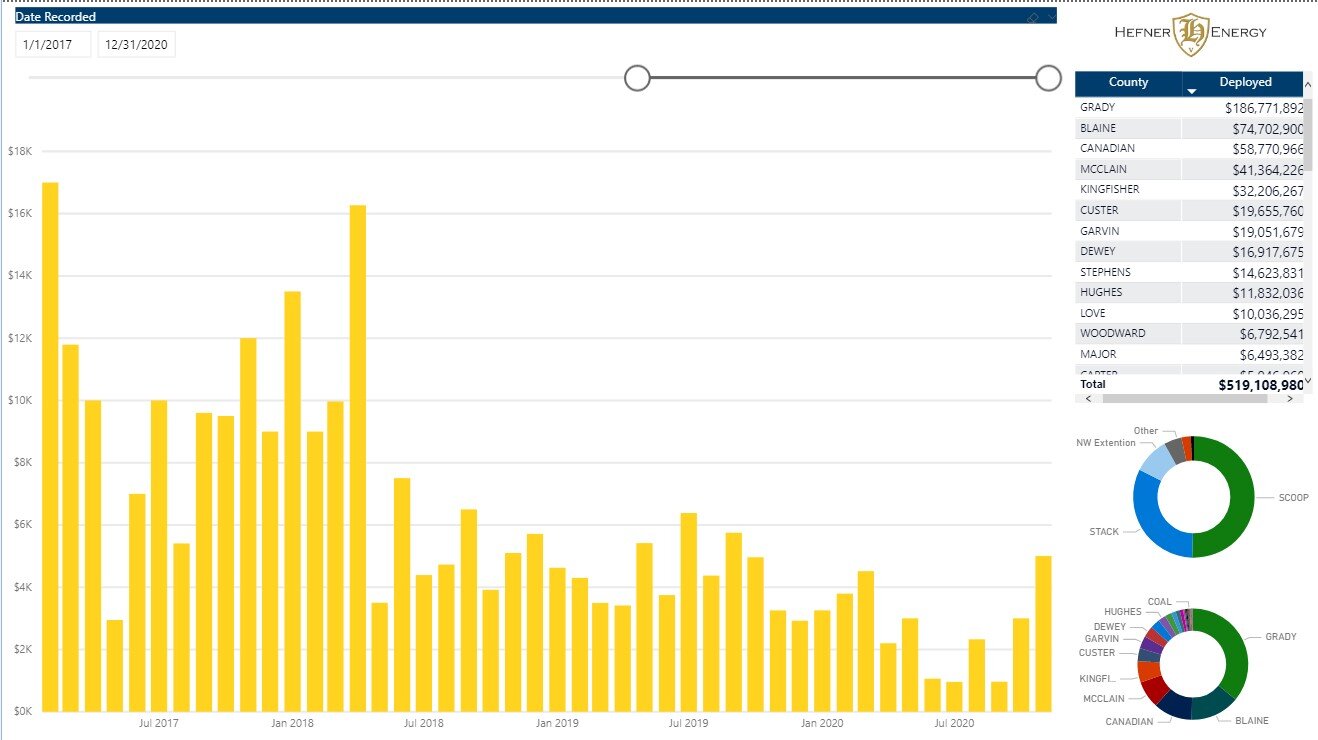

As told by the chart below, which plots the count of deeds and total dollars spent by month in Oklahoma, Oklahoma’s mineral and royalty market is at its worst point since the shale revolution began circa 2008.

Source: Hefner Energy, LLC

Moreover, it’s impossible to ignore the dramatic rise of private equity in the mineral and royalty space from 2016-2019, when over $1 billion was being spent per annum.

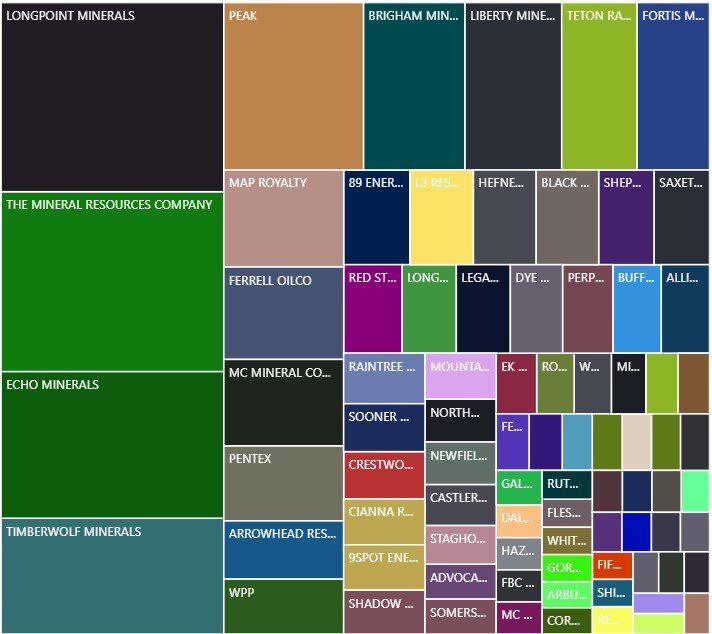

The Big Players since 2000

When filtering the data to companies that spent at least $10 million, there are only 82 companies on the list since 2000.

Source: Hefner Energy, LLC

The top 3 are:

Longpoint Minerals - $413.6 million

Mineral Resources Company (i.e. Continental Resources): $393.5 million

Echo Minerals: $320.5 million

The third-place firm on this list will likely surprise many because they haven’t been nearly as active as the other two in recent years. Regardless, they still must hold a considerable inventory that’s cash flowing quite nicely by now.

Their inclusion in the top three begs the question, who’s left standing?

Who’s Left Standing?

When you filter down further to which ones have spent just $2 million YTD, that list of 86 shrinks down to just 4 firms, of which two are publicly-traded (being CLR and MNRL).

In fact, if you were to spend just $5 million dollars this year buying minerals and royalties in Oklahoma you’d be the 3rd largest buyer of minerals in the whole state! Oh how the mighty have fallen.

Source: Hefner Energy, LLC (2019-2020)

“We Buy PDP” Move Buyers Back to the ‘Core’?

Source: Hefner Energy LLC

2008-2014

During this period, Oklahoma’s shales were still largely unknown and untested. As you might suspect, the percentage of dollars spent in each play were distributed somewhat evenly. During this period, only about 1/5th of the dollars spent were in what would become known as the SCOOP and the STACK.

Source: Hefner Energy LLC

2015-Q2.2016

During this period, the STACK was firming itself up to be the next hot play. The whole play was put squarely on the map in December 2015 when Devon Energy announced they were acquiring Felix Energy in a blockbuster $2.5 billion deal valuing leasehold in the $20,000 per acre ballpark. As one would suspect, the percentage of dollars allocated towards the STACK during this period was significant and it was. Unfortunately, the STACK fell out of favor once the Meramec was properly tested - initially with the Showboat and Mosasaurus units in 16N-09W, Kingfisher County. Investors were burned and they really haven’t come back since (good luck with the write downs about to happen in the Permian, btw).

Source: Hefner Energy LLC

Q3.2016-2019

This period begins June 2018, upon the blockbuster announcement by Continental Resources of its famed Project Springboard in the SCOOP. This was, and still is, the most aggressive density development the state has ever known. Continental announced they would drill 350 horizontal wells in a 9x9 mile contiguous area in central Grady County between three zones - the Springer, Sycamore, and Woodford - and the dollars flocked that way.

Source: Hefner Energy LLC

covid-20

To say this year has been challenging would be an understatement. It has sent rigs falling from more than 100 to single-digits (another record low I’m sure). It has sent firms to the graveyard, and very few mineral buyers are left standing. Of those still standing, they largely are equity players who managed to avoid leverage and they are now unanimously only paying for PDP (and trying to pay PV 15-25 at that).

I would have imagined the percentage of dollars would have sent acquisitions straight to the “core only” areas in only the SCOOP and STACK. Instead, about 1/4th of the market is paying for acreage in the non-SCOOP/STACK areas that are both undelineated and statistically challenging. I would have imagined that debt loads and PDP buyers would have been forced back to the cores of just the SCOOP and STACK where those challenges are mitigated.

Dollars Paid Per Acre Have Eroded

In addition to the volume of market transactions falling off the proverbial cliff, so have average prices paid per acre.

Source: Hefner Energy LLC

It is important to note:

these values are NOT normalized to 1/8th royalty or any other. In Oklahoma, the average royalty rate is 18.75% so, if you want to think in terms of price per NRA, you can normalize these prices downwards if anything.

The chart shows average price paid per acre across the entire state - the prices in core areas look vastly different, and our systems have been built to provide incredible, real-time transparency on every single transaction that occurs in the state.

The small “bump” in our data for November 2020 is encouraging. However, those who are waiting for pre-covid prices will undoubtedly be holding their breath for a very long time.

Thankful and Open for Business

I am fortunate for the transactional business this year, and quite thankful to all those involved. Without it, my life would look drastically different. Being able to transact this year has re-instilled a bit of lost confidence both in myself and the advanced analytics systems Hefner Energy spent five years developing for a market that seems so out of favor today.

These successes wouldn’t be possible without the broad shoulders of others, either. I’m thankful to my former partner, Justin Woody, an engineer who directly managed the Pinedale field taught me rock mechanics. As a result of his experience with downspacing to 2.5 acres, we avoided underwriting any more than 8 wells in any unit in the STACK when others were risking 14, or more.

The famous quote that luck is “preparation meeting opportunity” seems to fit this year. While the transaction we just closed might only result in a fraction of the revenue Hefner Energy has become accustomed to over the past few years, it also might be the only successful closing of a sizable mineral and royalty transaction in the market this year. We must celebrate the wins.

We are thankful to continue to be open for business. Oklahoma is down, but it’s not out.

We are actively acquiring minerals across the lower 48,

We offer minerals management services (you benefit from someone who manages their own portfolio), and

We offer exclusive advisory services, predicated upon our advanced data and analytics systems.

It has been a wonderful end to a very challenging year, and it’s not lost on me that most have not fared as well. We hope to be able to help others who could use a boost as well. If you think I can help you, I’m just a phone call or email away. Nothing is more satisfying than helping others. Cya 2020, and Godspeed to 2021.

Kind Regards,

Robert Hefner

PS. I feel compelled this morning to acknowledge that one of my peers passed tragically this past week. At 35 years old, Josh had a lot left to offer this world, the mineral and royalty business community, and Oklahoma City. I’m fairly certain that Josh was the most successful among us and ran a great series of companies including Peak Energy, Leffco, and Black Hawk Mineral Partners. I pray God grants your family peace and reveals His plan in what appears to be backwards and heartless to us all. Good can come from bad, as it did through the death of my third sister Aliya. I’m truly sorry for your loss Leffler family. Josh’s loss should remind each and every one of us how fragile life is - cherish it; tell those you love that you love them; leave it all on the field. Josh Leffler - RIP.